COBI

First red day Supernovae. Finished down over 46.5+ last time, so more down side might be unrealistic. If it had fallen much less than 10% then more could be expected as plausible. Always watch day 2 of a busted one. The plan is to play for more reddening on day 2. Conditional entry. A flat, nominally green or red open that immediately sells off on heavy volume or sports traditional confirmed weakness cues is a fade entry. Keep flat on high volume greening or strength, especially early. This is a lot more likely given the huge degree of reddening on Wednesday. No A/H quote. Avoid entries as a short on big gaps up or down, but down is probably worse. Keep flat on consistently strong price action, like trading above the opening price level. Avoid spike up long scalps, too. Selling volume was significant, so was price range. Not good shorting signs.

AKRX

See my previous comments on this. They have not changed, nor have the technical levels for entries or stops. Sometimes a range deficient or doji like print on the daily keeps a play alive on the next day, as is true here.

CBOU

This might be good for 0.30 cents of upside if it can take out 10.70, more conservatively, 10.75 with a stop just under the break out level. Approached it on low volume today, not a bad sign. Possible fade on a fail at the same ceiling and a drop back under aggressively. We've reached the same level at least 3 times in the past few months, with no sustained success over to 11, where some resistance sits. A live price action situation.

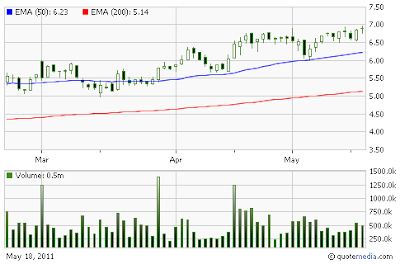

MITK

Solidly breaking out over 6.50 and 6.75 on favorably modest volume, this might have more if it can hold 7. Also new 52's. Short term, these yearly high stocks usually go higher. Consistently strong price action, like trading above the opening price level after the first 5 minutes, is a long. Or, if it gaps down a bit to debut or opens flat and falls briefly, a red to green and hold with strong volume. Also long on spiking up at or near the gun as a scalp. This might be an EOD exit, depending on how it holds up. Also long on a break above to new yearly highs and holds. No A/H quote. No shorts, keep flat on true weakness.

AVNR

I like this long over 4.53 with continued momentum. A fail at 4.50 (with a test) is potential fade play. Down a bit A/H so an early red to green needs to happen for the Bulls to enter. Avoid all big gaps and do not short without the aforementioned test. Not an entry short on immediate dropping without testing. A gap just over the ceiling and a fall back under is a potential fade, though.

ENSL

Cheapie that laid waste to Tweezer Tops at 0.08 that I like on over extension and a fall back under 0.09 for a fade play. Not into a long despite it conquering some real resistance at 0.08 as it's up way too much but it needs to panic dump/sport clear weakness cues for me to take the bait. Squeeze potential is all to real here, but as I said keep flat on further greening.

CTICD

Volume coming in now. Possible early red to green long and over 1.75ish resistance area for a continuation tomorrow. On on spiking up from the gun. Keep flat on real weakness. After 1.80 a gap might be filled to 2 if this pans out on a swing hold. A stop just under 1.50 seems about the most liberal risk to permit here.

Off table, watch PVSP for a possible short on a fail fall back under 0.06 tomorrow. Over extending, but still with great rising volume, so it might not be over. A reasonable gap over and a drop back under our level is possible to fade as well. Avoid all big gaps. Not on the main list as it's a bit too cheap and choppy, etc.

Review my blog at Investimonials:

Follow me now on Twitter:

Watch my instructional trading videos on YouTube:

Subscribe to Big T by e-mail:

Subscribe to Big T in a news reader:

The blog has a terms of service. Be sure to read it at:

http://traderbigt.blogspot.com/2010/02/please-read-my-terms-of-service-i.html

First red day Supernovae. Finished down over 46.5+ last time, so more down side might be unrealistic. If it had fallen much less than 10% then more could be expected as plausible. Always watch day 2 of a busted one. The plan is to play for more reddening on day 2. Conditional entry. A flat, nominally green or red open that immediately sells off on heavy volume or sports traditional confirmed weakness cues is a fade entry. Keep flat on high volume greening or strength, especially early. This is a lot more likely given the huge degree of reddening on Wednesday. No A/H quote. Avoid entries as a short on big gaps up or down, but down is probably worse. Keep flat on consistently strong price action, like trading above the opening price level. Avoid spike up long scalps, too. Selling volume was significant, so was price range. Not good shorting signs.

AKRX

See my previous comments on this. They have not changed, nor have the technical levels for entries or stops. Sometimes a range deficient or doji like print on the daily keeps a play alive on the next day, as is true here.

CBOU

This might be good for 0.30 cents of upside if it can take out 10.70, more conservatively, 10.75 with a stop just under the break out level. Approached it on low volume today, not a bad sign. Possible fade on a fail at the same ceiling and a drop back under aggressively. We've reached the same level at least 3 times in the past few months, with no sustained success over to 11, where some resistance sits. A live price action situation.

MITK

Solidly breaking out over 6.50 and 6.75 on favorably modest volume, this might have more if it can hold 7. Also new 52's. Short term, these yearly high stocks usually go higher. Consistently strong price action, like trading above the opening price level after the first 5 minutes, is a long. Or, if it gaps down a bit to debut or opens flat and falls briefly, a red to green and hold with strong volume. Also long on spiking up at or near the gun as a scalp. This might be an EOD exit, depending on how it holds up. Also long on a break above to new yearly highs and holds. No A/H quote. No shorts, keep flat on true weakness.

AVNR

I like this long over 4.53 with continued momentum. A fail at 4.50 (with a test) is potential fade play. Down a bit A/H so an early red to green needs to happen for the Bulls to enter. Avoid all big gaps and do not short without the aforementioned test. Not an entry short on immediate dropping without testing. A gap just over the ceiling and a fall back under is a potential fade, though.

ENSL

Cheapie that laid waste to Tweezer Tops at 0.08 that I like on over extension and a fall back under 0.09 for a fade play. Not into a long despite it conquering some real resistance at 0.08 as it's up way too much but it needs to panic dump/sport clear weakness cues for me to take the bait. Squeeze potential is all to real here, but as I said keep flat on further greening.

CTICD

Volume coming in now. Possible early red to green long and over 1.75ish resistance area for a continuation tomorrow. On on spiking up from the gun. Keep flat on real weakness. After 1.80 a gap might be filled to 2 if this pans out on a swing hold. A stop just under 1.50 seems about the most liberal risk to permit here.

Off table, watch PVSP for a possible short on a fail fall back under 0.06 tomorrow. Over extending, but still with great rising volume, so it might not be over. A reasonable gap over and a drop back under our level is possible to fade as well. Avoid all big gaps. Not on the main list as it's a bit too cheap and choppy, etc.

Review my blog at Investimonials:

Follow me now on Twitter:

Watch my instructional trading videos on YouTube:

Subscribe to Big T by e-mail:

Subscribe to Big T in a news reader:

The blog has a terms of service. Be sure to read it at:

http://traderbigt.blogspot.com/2010/02/please-read-my-terms-of-service-i.html

No comments:

Post a Comment