NFEC

First red day Supernovae. Finished down more than 18% last time, so more down side might not be in the cards. If it had fallen much less than 10% then more could be expected as plausible. Always watch day 2 of a busted one. The plan is to play for more reddening on day 2. Conditional entry. A flat, nominally green or red open that immediately sells off on heavy volume or sports traditional confirmed weakness cues is a fade entry. Keep flat on high volume greening or strength, especially early. This fairly likely given the big red result of Monday. Avoid entries as a short on big gaps up or down, but down is probably worse. Keep flat on consistently strong price action, like trading above the opening price level after the noise candle. Avoid spike up long scalps, too. Sell volume was small, range moderate. Mixed signals for new shorts. Stops over 2.20.

BIZZ

Supernovae, still maturing. See my comments for last time, mostly still applicable. It greened another 19%+ so hopefully it will weaken without fake outs soon. Hammer on the upside print on the daily, another good sign.

SEFE

Once again refer to my comments from last time or two, still in effect. We peaked a cent under the previous resistance point and suffered a fake out short. Keep monitoring it for another fade entry. Stops just over 1.25.

VRNG

Once again making my new Supernovae scan. Down a tad A/H. Comments similar to that for NFEC on Friday. See those for details. Obey stops, get out over 3.50+ and avoid longs. Scamex low float squeezer.

CREG

Red floater scan return. Idea is to play for more down side on day 2. Ended down over 7% on Monday via a gap up that closed below the open after a few up days. Stops just above 2.48 tops to cap losses on head fake fade entries. I'm only into the shorting possibility if it surfaces, keeping flat on strength. Also a short on heavy volume dumps/confirmed weakness cues. Fairly modest sell volume on Monday which means it may have acceptable chances for shorts. Avoid all big gaps, especially large gap downs. No buys.

FCEL

Bullish Engulfing. I like this long over the high (1.36) of Monday. Small volume on the rise, which is a decent sign for new buyers. Keep flat on real weakness aside from a typical red to green move, etc. Stops just under the low last time or the initial 30 minute one on Tuesday. More conservatively a stop placed under Monday's close, too. The low on that day is arguably not too far away to use for risk management via stops. Ideally stays above 1.26 on pull backs to remain viable as a long if it triggers. No big gaps/shorts or A/H quote tilt.

WG

A pennant style consolidation may yield a continuation play above Monday's high (3.77) for further gains as a long entry. Stops just under 3.62 A failed chart pattern entry on a break under 3.62 is possible, too. Also a long on consistent moves above the open after the noise candle, or on spiking up at or near the gun as a scalp buy. A fade scalp on panic dumps at any time and especially back under 3.62 Wait for a test/fail here if it gaps below that. No A/H quote. Avoid all big gaps.

New users: Read my trading guide for my play set-ups!

Review my blog at Investimonials:

Follow me now on Twitter:

Watch my instructional trading videos on YouTube:

Subscribe to Big T by e-mail:

Subscribe to Big T in a news reader:

The blog has a terms of service. Be sure to read it at:

http://traderbigt.blogspot.com/2010/02/please-read-my-terms-of-service-i.html

First red day Supernovae. Finished down more than 18% last time, so more down side might not be in the cards. If it had fallen much less than 10% then more could be expected as plausible. Always watch day 2 of a busted one. The plan is to play for more reddening on day 2. Conditional entry. A flat, nominally green or red open that immediately sells off on heavy volume or sports traditional confirmed weakness cues is a fade entry. Keep flat on high volume greening or strength, especially early. This fairly likely given the big red result of Monday. Avoid entries as a short on big gaps up or down, but down is probably worse. Keep flat on consistently strong price action, like trading above the opening price level after the noise candle. Avoid spike up long scalps, too. Sell volume was small, range moderate. Mixed signals for new shorts. Stops over 2.20.

BIZZ

Supernovae, still maturing. See my comments for last time, mostly still applicable. It greened another 19%+ so hopefully it will weaken without fake outs soon. Hammer on the upside print on the daily, another good sign.

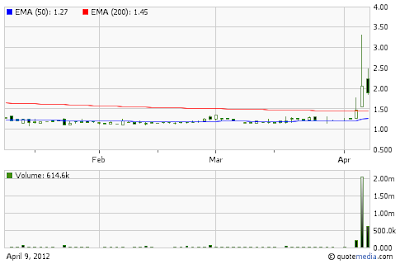

SEFE

Once again refer to my comments from last time or two, still in effect. We peaked a cent under the previous resistance point and suffered a fake out short. Keep monitoring it for another fade entry. Stops just over 1.25.

VRNG

Once again making my new Supernovae scan. Down a tad A/H. Comments similar to that for NFEC on Friday. See those for details. Obey stops, get out over 3.50+ and avoid longs. Scamex low float squeezer.

CREG

Red floater scan return. Idea is to play for more down side on day 2. Ended down over 7% on Monday via a gap up that closed below the open after a few up days. Stops just above 2.48 tops to cap losses on head fake fade entries. I'm only into the shorting possibility if it surfaces, keeping flat on strength. Also a short on heavy volume dumps/confirmed weakness cues. Fairly modest sell volume on Monday which means it may have acceptable chances for shorts. Avoid all big gaps, especially large gap downs. No buys.

FCEL

Bullish Engulfing. I like this long over the high (1.36) of Monday. Small volume on the rise, which is a decent sign for new buyers. Keep flat on real weakness aside from a typical red to green move, etc. Stops just under the low last time or the initial 30 minute one on Tuesday. More conservatively a stop placed under Monday's close, too. The low on that day is arguably not too far away to use for risk management via stops. Ideally stays above 1.26 on pull backs to remain viable as a long if it triggers. No big gaps/shorts or A/H quote tilt.

WG

A pennant style consolidation may yield a continuation play above Monday's high (3.77) for further gains as a long entry. Stops just under 3.62 A failed chart pattern entry on a break under 3.62 is possible, too. Also a long on consistent moves above the open after the noise candle, or on spiking up at or near the gun as a scalp buy. A fade scalp on panic dumps at any time and especially back under 3.62 Wait for a test/fail here if it gaps below that. No A/H quote. Avoid all big gaps.

New users: Read my trading guide for my play set-ups!

Review my blog at Investimonials:

Follow me now on Twitter:

Watch my instructional trading videos on YouTube:

Subscribe to Big T by e-mail:

Subscribe to Big T in a news reader:

The blog has a terms of service. Be sure to read it at:

http://traderbigt.blogspot.com/2010/02/please-read-my-terms-of-service-i.html

No comments:

Post a Comment