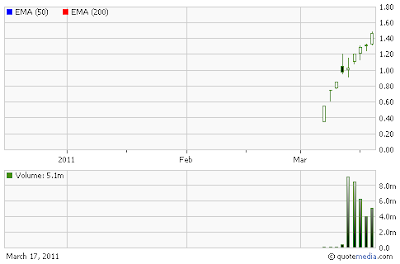

CTIC

New Supernovae scan return. Closed on the highs. Up over 32% today. Up less than 2% after hours. If it opens a bit down, it might yield a rapid red to green on Friday which can be longed for a scalp or more, depending on how it holds up. Cancer news catalyst with possible legs, but the news is from the 16th. Also a long scalp on at or near bell spiking up. Conditional fade entry. A fade on confirmed weakness cues or heavy dumping on volume from or near the bell. Ideal is a flat or barely green or red open, followed by a big move down on volume to short into. Avoid big gaps, especially downward ones. Do not short into initial strength or greening. Box to drop if you do not want to buy and prefer to wait for the distribution print, avoid top fish timing fades. Be patient and wait for weakening if waiting to short.

ALZM

I was a bit overly pessimistic on the long option on this incher. It seems to be supported by some hidden hands. See my analysis from last time and the one prior, which are mostly still in force. Still in play both ways, depending on events. If it looks strong and gaps up and inches from the open, it can be cautiously longed with constant monitoring. Or if it gaps down a tad and goes red to green and holds. But beware the plug can be pulled and when it does, it might be sudden and fast, with days of gains gone in minutes. It's a short on confirmed weakness cues or morning panic style dumps, whenever they occur. Boxing is an angle for shorts.

UTOG

Another incher/program. see my comment for ALZM above, they are mostly applicable. It might have bit more left, but also look out for a major dump to short into. Very much in play both ways, like the other one.

LOGL

3 great days with ever increasing volume, this incher may have some funny business behind it as well, but it keeps greening. Again, see my comments for ALZM and UTOG above, they are relatively similar. This one is also in play both ways. I suspect most will hope the long plays work on all 3, to avoid share locates.

TNP

Earnings reported on 3/14/11. Nice moves since. Looks like it's over extending, but a look at the daily chart shows it is trying to reach for a ceiling at 11. Possible 11 test again, it stalled there. Above that a big gap in the daily chart exists, so if it takes and holds that it begins a try to eventually close that gap. In play both ways. If it conquers 11 it's a long. If it fails there it can be shorted on the way back down. I think the fail is more likely. It might not even try to test that level, with a flat or nominally up/down open which dumps, that is also a short.

JVA

Yet another stock in play both ways. Not like the previous 3 stocks, though. This one is up after hours over 6. Possible scalp long on spikes at or near the bell. If the stock gaps up as expected, and just consistently prints over the opening price level, long on that, with possibly more holding time. Or, if it quickly falls back under 6 or otherwise morning panic style dumps from the open, or at any time, it is a fade entry. New 52s, but it greened over 33.5% today, so have realistic expectations a long. As a perma Bear, I want the 6 fail.

MNTX

Earnings winner that approached new 52's today but fell a bit short. Those are at 6.50 but it topped out at 6.41 on the session. Down to 6.30 after hours, so an early red to green long might be in the cards. Or a scalp long on at or near bell spikes. Also long on new yearly highs and holds, as it might keep going. Keep flat on enduring weakness, it is usually a bad idea to short these situations. Early nominal red that fast greens, as mentioned above, is not to be confused with real weakening signs.

Unofficially, I am watching a pump on JAMN that might fail at 1.30 or so. It closed at 1.25 and some resistance is there. In promotions that counts for little though, admittedly. If it powers over that it might keep going, if they push it tonight online. Obviously confirmed weakness cues or morning panic style dumps at any time are fade entries. As is the fail at 1.30 on a test. It could just inch up all day for longs, so keep an open mind and let live price action decide, as it's in play both ways Friday.

Review my blog at Investimonials:

Follow me now on Twitter:

Watch my instructional trading videos on YouTube:

Subscribe to Big T by e-mail:

Subscribe to Big T in a news reader:

The blog has a terms of service. Be sure to read it at:

http://traderbigt.blogspot.com/2010/02/please-read-my-terms-of-service-i.html

New Supernovae scan return. Closed on the highs. Up over 32% today. Up less than 2% after hours. If it opens a bit down, it might yield a rapid red to green on Friday which can be longed for a scalp or more, depending on how it holds up. Cancer news catalyst with possible legs, but the news is from the 16th. Also a long scalp on at or near bell spiking up. Conditional fade entry. A fade on confirmed weakness cues or heavy dumping on volume from or near the bell. Ideal is a flat or barely green or red open, followed by a big move down on volume to short into. Avoid big gaps, especially downward ones. Do not short into initial strength or greening. Box to drop if you do not want to buy and prefer to wait for the distribution print, avoid top fish timing fades. Be patient and wait for weakening if waiting to short.

ALZM

I was a bit overly pessimistic on the long option on this incher. It seems to be supported by some hidden hands. See my analysis from last time and the one prior, which are mostly still in force. Still in play both ways, depending on events. If it looks strong and gaps up and inches from the open, it can be cautiously longed with constant monitoring. Or if it gaps down a tad and goes red to green and holds. But beware the plug can be pulled and when it does, it might be sudden and fast, with days of gains gone in minutes. It's a short on confirmed weakness cues or morning panic style dumps, whenever they occur. Boxing is an angle for shorts.

UTOG

Another incher/program. see my comment for ALZM above, they are mostly applicable. It might have bit more left, but also look out for a major dump to short into. Very much in play both ways, like the other one.

LOGL

3 great days with ever increasing volume, this incher may have some funny business behind it as well, but it keeps greening. Again, see my comments for ALZM and UTOG above, they are relatively similar. This one is also in play both ways. I suspect most will hope the long plays work on all 3, to avoid share locates.

TNP

Earnings reported on 3/14/11. Nice moves since. Looks like it's over extending, but a look at the daily chart shows it is trying to reach for a ceiling at 11. Possible 11 test again, it stalled there. Above that a big gap in the daily chart exists, so if it takes and holds that it begins a try to eventually close that gap. In play both ways. If it conquers 11 it's a long. If it fails there it can be shorted on the way back down. I think the fail is more likely. It might not even try to test that level, with a flat or nominally up/down open which dumps, that is also a short.

JVA

Yet another stock in play both ways. Not like the previous 3 stocks, though. This one is up after hours over 6. Possible scalp long on spikes at or near the bell. If the stock gaps up as expected, and just consistently prints over the opening price level, long on that, with possibly more holding time. Or, if it quickly falls back under 6 or otherwise morning panic style dumps from the open, or at any time, it is a fade entry. New 52s, but it greened over 33.5% today, so have realistic expectations a long. As a perma Bear, I want the 6 fail.

MNTX

Earnings winner that approached new 52's today but fell a bit short. Those are at 6.50 but it topped out at 6.41 on the session. Down to 6.30 after hours, so an early red to green long might be in the cards. Or a scalp long on at or near bell spikes. Also long on new yearly highs and holds, as it might keep going. Keep flat on enduring weakness, it is usually a bad idea to short these situations. Early nominal red that fast greens, as mentioned above, is not to be confused with real weakening signs.

Unofficially, I am watching a pump on JAMN that might fail at 1.30 or so. It closed at 1.25 and some resistance is there. In promotions that counts for little though, admittedly. If it powers over that it might keep going, if they push it tonight online. Obviously confirmed weakness cues or morning panic style dumps at any time are fade entries. As is the fail at 1.30 on a test. It could just inch up all day for longs, so keep an open mind and let live price action decide, as it's in play both ways Friday.

Review my blog at Investimonials:

Follow me now on Twitter:

Watch my instructional trading videos on YouTube:

Subscribe to Big T by e-mail:

Subscribe to Big T in a news reader:

The blog has a terms of service. Be sure to read it at:

http://traderbigt.blogspot.com/2010/02/please-read-my-terms-of-service-i.html

No comments:

Post a Comment