LEXG

Long bias until proven otherwise, but this is just positively absurd now. Now a full fledged Supernovae, the previous runner has gone plain parabolic. A constantly monitored long is possible, with spiking up early and positive price action only. Given the number of naive early shorts being toasted and committing suicide on this, that's still possible. A world class short beckons once this dumps, which is probably soon. See also my previous comments. Then again, I have been saying this pig was due to dive since 3 bucks, LOL!

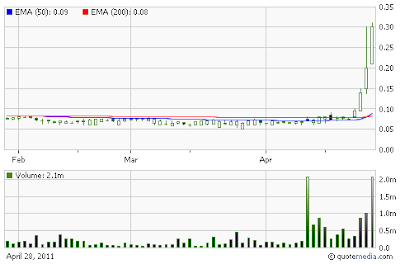

LTUM

New Supernovae scan return. An old Lebed pick, if memory serves me correctly. I bet he's gloating now over this unrelated result. A one day wonder, which closed off of the highs. Volume has picked up a lot. Eventually this can be shorted since it is up so absurdly. I suspect like many such plays it can go further than anyone expects, though. Conditional entry. On a higher open, it might yield a rapid green to red on Friday and spike down for a short scalp. This might even be a gap and crap. A fade on confirmed weakness cues or heavy dumping on volume from or near the bell. Ideal is a flat or barely green or red open, followed by a big move down on volume to short into. Avoid big gaps, especially downward ones. Do not short into initial strength or greening. Box and drop to wait for the distribution print, if desired and avoid top fish timing fades. Keep flat on positive price action, avoid scalping long, given the 343.5% move up today. No A/H quote.

WSGI

Another new Supernovae on scan. This one has moved up with gaps and sizable candles the past 3-4 days. Volume is increasing. Analysis is otherwise similar to that of LTUM above. See that for entry/exit/play management tips on this. I think this one recently changed its ticker symbol, and put out PR that is being picked up by the usual "me too" lists recently. I am waiting to fade it, not into a long here anymore.

TLON

Color me still skeptical, and see my previous comments for entry/exit/play management tips, which are still in force mostly. Now a Red Floater scan return, the idea is to play for down side next time. It opened on a gap up that closed under the opening price level, but due to the gap it still showed a gain on the session.

HPY

Nice set up here on the cup correction and ceiling of 20 bucks. Long over that taking and holding with volume. It's tried several times since February, but no luck. Short on a failed test of the same or a dump out of the open. Avoid big gaps. If it gaps just over 20 wait to see if it holds and perks up off of there to go long, or a quick trip back under to short the false break out. Any fail of 20 is fade bait. New 52's are at 19.91

AURI

Now being promoted, an incher cheapie since February we now have a B/O above resistance at 0.65 so the key is if it can survive a test on a gap over or flat debut with a perk back up off to go long, possibly as a swing. A fade entry on a fail back under the above level on a broken chart pattern. See also this recent article:

http://www.hotstocked.com/article/5532/promoters-alert-auri-inc-otc-auri-for-another.html

MNKD

4.50 test again? We now approach a resistance point last hit in February. Interesting chart. Once that is taken out on volume and holds with acceleration, it's a long. A small gap over and perking up off of there, is too. A dive back under and holds is a fade entry. Also possible is an immediate dump on volume/confirmed weakness cues to short into. I am skeptical of longs looking at a long term chart, so I'm hoping for fade cues. The best outcome is a clear fail with a test of our technical level above. Plenty of short interest outstanding.

Review my blog at Investimonials:

Follow me now on Twitter:

Watch my instructional trading videos on YouTube:

Subscribe to Big T by e-mail:

Subscribe to Big T in a news reader:

The blog has a terms of service. Be sure to read it at:

http://traderbigt.blogspot.com/2010/02/please-read-my-terms-of-service-i.html

Long bias until proven otherwise, but this is just positively absurd now. Now a full fledged Supernovae, the previous runner has gone plain parabolic. A constantly monitored long is possible, with spiking up early and positive price action only. Given the number of naive early shorts being toasted and committing suicide on this, that's still possible. A world class short beckons once this dumps, which is probably soon. See also my previous comments. Then again, I have been saying this pig was due to dive since 3 bucks, LOL!

LTUM

New Supernovae scan return. An old Lebed pick, if memory serves me correctly. I bet he's gloating now over this unrelated result. A one day wonder, which closed off of the highs. Volume has picked up a lot. Eventually this can be shorted since it is up so absurdly. I suspect like many such plays it can go further than anyone expects, though. Conditional entry. On a higher open, it might yield a rapid green to red on Friday and spike down for a short scalp. This might even be a gap and crap. A fade on confirmed weakness cues or heavy dumping on volume from or near the bell. Ideal is a flat or barely green or red open, followed by a big move down on volume to short into. Avoid big gaps, especially downward ones. Do not short into initial strength or greening. Box and drop to wait for the distribution print, if desired and avoid top fish timing fades. Keep flat on positive price action, avoid scalping long, given the 343.5% move up today. No A/H quote.

WSGI

Another new Supernovae on scan. This one has moved up with gaps and sizable candles the past 3-4 days. Volume is increasing. Analysis is otherwise similar to that of LTUM above. See that for entry/exit/play management tips on this. I think this one recently changed its ticker symbol, and put out PR that is being picked up by the usual "me too" lists recently. I am waiting to fade it, not into a long here anymore.

TLON

Color me still skeptical, and see my previous comments for entry/exit/play management tips, which are still in force mostly. Now a Red Floater scan return, the idea is to play for down side next time. It opened on a gap up that closed under the opening price level, but due to the gap it still showed a gain on the session.

HPY

Nice set up here on the cup correction and ceiling of 20 bucks. Long over that taking and holding with volume. It's tried several times since February, but no luck. Short on a failed test of the same or a dump out of the open. Avoid big gaps. If it gaps just over 20 wait to see if it holds and perks up off of there to go long, or a quick trip back under to short the false break out. Any fail of 20 is fade bait. New 52's are at 19.91

AURI

Now being promoted, an incher cheapie since February we now have a B/O above resistance at 0.65 so the key is if it can survive a test on a gap over or flat debut with a perk back up off to go long, possibly as a swing. A fade entry on a fail back under the above level on a broken chart pattern. See also this recent article:

http://www.hotstocked.com/article/5532/promoters-alert-auri-inc-otc-auri-for-another.html

MNKD

4.50 test again? We now approach a resistance point last hit in February. Interesting chart. Once that is taken out on volume and holds with acceleration, it's a long. A small gap over and perking up off of there, is too. A dive back under and holds is a fade entry. Also possible is an immediate dump on volume/confirmed weakness cues to short into. I am skeptical of longs looking at a long term chart, so I'm hoping for fade cues. The best outcome is a clear fail with a test of our technical level above. Plenty of short interest outstanding.

Review my blog at Investimonials:

Follow me now on Twitter:

Watch my instructional trading videos on YouTube:

Subscribe to Big T by e-mail:

Subscribe to Big T in a news reader:

The blog has a terms of service. Be sure to read it at:

http://traderbigt.blogspot.com/2010/02/please-read-my-terms-of-service-i.html

No comments:

Post a Comment