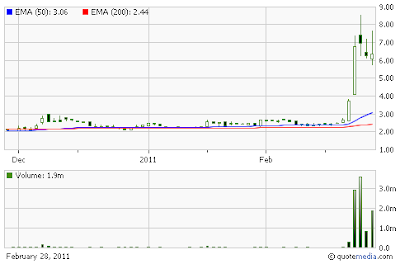

ROYL

See my prior comments for this now technically failed for gravy 1st red day Supernovae, they mostly still apply. Volume on the buy side is fading, although it made new highs today. Hopefully no fake outs will arise as was the case for today. This and BDCO are still potential shorts.

BDCO

See my comments for last time on this now technically failed for gravy 1st red day Supernovae, as they mostly still apply. Volume on the buy side is fading, which is a good sign. Fake out whip saws happened today.

AUGT

Nice chart pattern consolidation with break out. New 52's. Short term, these usually go higher still. Consistently strong price action, like trading above the opening price level after the first 5 minutes, is a long. Or, if it gaps down a bit or opens flat and falls briefly, a red to green and hold with strong volume. At least a long scalp on spiking up at or near the gun. Avoid shorts, keeping flat on any signs of enduring weakness.

AMZG

Continues to inch up on nice volume. See my comments from last time, they mostly still apply. Getting late in the day to swing this, but if it at least opens flat and perks up off that and holds, it is a cautious long. One with a finger on the sell button at all times with constant monitoring. Now on watch as well for a scalp short with a slippage limiting market order if it dumps on heavy volume at any time. Plays like this can lose tons in minutes.

DPTR

Now nearing over extension, this one has advanced 4 sessions running with some gaps. Lots of momentum here and up after hours, a hot energy sector play. Do not try to top fish this. It is a long scalp on open or near gun spiking up. A decent profit taking short should arrive soon, too. I do not want to top fish it, but if it spikes, this might be possible. Better is to just wait beyond the initial 5 minutes and if it is trading clearly under the opening price, then a fade play beckons. Also a fade on morning panic style dumping, at any point. An early green to red is also a short if it gaps and craps and keeps going. Always fade only weakness if possible.

COYR

Biggest volume yet. More upside today, like 7 sessions in a row. I hear a physical mailer exists on this rapidly over extending equity. Similar comments as for DPTR in terms of general strategy, long and short, except that it could dump and provide a short scalp using a slippage limiting market order. This is because when the front loaders dump their pump, it will probably fall very hard very far and fast.

BULM

Since Friday, the company announced a blowout quarter, and it was promoted by Lebed, who was compensated handily. Short term, this might go a bit higher. I like it as long scalp on spiking up at or near the bell. See the following article: http://www.hotstocked.com/article/4086/bullion-monarch-mining-inc-otc-bulm-climbs-up.html Just keep flat on weakness, and only long it on continued strong price action, like an early red to green and holds or a flat or modest gap up and consistent pricing above the opening price level.

Other stocks I am watching off record include EPM a 52's play with great volume into the close, AMEL which is a blast from the past and possible long swing, ROYE which I am looking to fade as soon as it clearly weakens, KNKT which is squeezing shorts and might have a bit more left up but will be a great fade shortly.

Review my blog at Investimonials:

Follow me now on Twitter:

Watch my instructional trading videos on YouTube:

Subscribe to Big T by e-mail:

Subscribe to Big T in a news reader:

The blog has a terms of service. Be sure to read it at:

http://traderbigt.blogspot.com/2010/02/please-read-my-terms-of-service-i.html

See my prior comments for this now technically failed for gravy 1st red day Supernovae, they mostly still apply. Volume on the buy side is fading, although it made new highs today. Hopefully no fake outs will arise as was the case for today. This and BDCO are still potential shorts.

BDCO

See my comments for last time on this now technically failed for gravy 1st red day Supernovae, as they mostly still apply. Volume on the buy side is fading, which is a good sign. Fake out whip saws happened today.

AUGT

Nice chart pattern consolidation with break out. New 52's. Short term, these usually go higher still. Consistently strong price action, like trading above the opening price level after the first 5 minutes, is a long. Or, if it gaps down a bit or opens flat and falls briefly, a red to green and hold with strong volume. At least a long scalp on spiking up at or near the gun. Avoid shorts, keeping flat on any signs of enduring weakness.

AMZG

Continues to inch up on nice volume. See my comments from last time, they mostly still apply. Getting late in the day to swing this, but if it at least opens flat and perks up off that and holds, it is a cautious long. One with a finger on the sell button at all times with constant monitoring. Now on watch as well for a scalp short with a slippage limiting market order if it dumps on heavy volume at any time. Plays like this can lose tons in minutes.

DPTR

Now nearing over extension, this one has advanced 4 sessions running with some gaps. Lots of momentum here and up after hours, a hot energy sector play. Do not try to top fish this. It is a long scalp on open or near gun spiking up. A decent profit taking short should arrive soon, too. I do not want to top fish it, but if it spikes, this might be possible. Better is to just wait beyond the initial 5 minutes and if it is trading clearly under the opening price, then a fade play beckons. Also a fade on morning panic style dumping, at any point. An early green to red is also a short if it gaps and craps and keeps going. Always fade only weakness if possible.

COYR

Biggest volume yet. More upside today, like 7 sessions in a row. I hear a physical mailer exists on this rapidly over extending equity. Similar comments as for DPTR in terms of general strategy, long and short, except that it could dump and provide a short scalp using a slippage limiting market order. This is because when the front loaders dump their pump, it will probably fall very hard very far and fast.

BULM

Since Friday, the company announced a blowout quarter, and it was promoted by Lebed, who was compensated handily. Short term, this might go a bit higher. I like it as long scalp on spiking up at or near the bell. See the following article: http://www.hotstocked.com/article/4086/bullion-monarch-mining-inc-otc-bulm-climbs-up.html Just keep flat on weakness, and only long it on continued strong price action, like an early red to green and holds or a flat or modest gap up and consistent pricing above the opening price level.

Other stocks I am watching off record include EPM a 52's play with great volume into the close, AMEL which is a blast from the past and possible long swing, ROYE which I am looking to fade as soon as it clearly weakens, KNKT which is squeezing shorts and might have a bit more left up but will be a great fade shortly.

Review my blog at Investimonials:

Follow me now on Twitter:

Watch my instructional trading videos on YouTube:

Subscribe to Big T by e-mail:

Subscribe to Big T in a news reader:

The blog has a terms of service. Be sure to read it at:

http://traderbigt.blogspot.com/2010/02/please-read-my-terms-of-service-i.html

No comments:

Post a Comment