LEXG

I know I sound like a broken record on this by now, but what an incredible run! Longs are still in charge, though confirmed weakness cues or morning panic dumps are short entries. Positive price action is another long entry. See my previous comments on this, which are still appropriate. Over 3 now, how far can it go?

MONT

New Supernovae scan return. Low volume riser initially, and it closed off of the highs. Volume has picked up a lot. This probably sneaked up on a lot of people. Eventually this can be shorted since it is up so absurdly. I suspect like many such plays it can go further than anyone expects, though. Conditional entry. On a higher open, it might yield a rapid green to red on Thursday and spike down for a short scalp. This might even be a gap and crap. A fade on confirmed weakness cues or heavy dumping on volume from or near the bell. Ideal is a flat or barely green or red open, followed by a big move down on volume to short into. Avoid big gaps, especially downward ones. Do not short into initial strength or greening. Box and drop to wait for the distribution print, if desired and avoid top fish timing fades. Keep flat on positive price action, avoid scalping long, since it has sported more measured moves on up. Down over 5% after hours, but this is still in play.

TECO

Cheapie I have been following a while now and just added to my main list as a possible short. It might not be done yet, possibly .10 could hit before a sell off. Up about 6.5% A/H. A firm with more liabilities than assets, I am short on confirmed weakness cues or heavy volume sell dumps anywhere they arise. I'm flat on more greening or positive price action, since this is up so much already and mostly on PR.

TIVO

In play 2 ways. First, given the legal news and excitement it might spike up hard for a few candles from or near the gun, which is a long scalp entry and exit on dying momentum. Second, given that it is up another 2% after hours over 11, we might see an early or from bell dump, to short scalp with a possible EOD exit or day trade short on a fall back under the above number. I am hoping for a more measured move to fade into.

JAG

6 test looming. Possible long on the attempt, and certainly on a take and hold with volume of that level. Another early feedback set up which is usually desirable. This helps in formulating stops. Potential short on a fail at 6 or a dump at or near the bell. No move on the A/H quote. Nice moves, gaps and volume recently.

ACAD

New 52's. Short term, these yearly high stocks usually go higher. Consistently strong price action, like trading above the opening price level after the first 5 minutes, is a long. Or, if it gaps down a bit to debut or opens flat and falls briefly, a red to green and hold with strong volume. Also long on spiking up at or near the gun as a scalp. This might be an EOD exit, depending on how it holds up. Also long on a break above to new yearly highs and holds. Avoid shorts. Keep flat on enduring weakness. No after hours quote shift. A pull back entry on a 2 test that solidly holds and retools back upwards is possible for long swings. This might be ideal in fact.

IMRS

Analysis is similar as for the above stock, with some explanations and differences. Almost at new yearly highs, this one is also up A/H even closer. This is at 8.42 and I am long on a take and hold of that with volume. A clear fail there is a fade entry. Another early feedback type set up which helps with stops and assessment.

Off record, I am also watching FLWS another new 52's situation. Earnings at open on Thursday, so be aware of possible selling into the report. Up almost 5% A/H with a possible 4 test in view. If that holds it could be longed. High potential for a fail at 4, which could be faded. An earnings play at yearly highs shorted? It's risky but the psychology is there at 4 if they decide to sell off it. Not on my main list given the variables.

Review my blog at Investimonials:

Follow me now on Twitter:

Watch my instructional trading videos on YouTube:

Subscribe to Big T by e-mail:

Subscribe to Big T in a news reader:

The blog has a terms of service. Be sure to read it at:

http://traderbigt.blogspot.com/2010/02/please-read-my-terms-of-service-i.html

I know I sound like a broken record on this by now, but what an incredible run! Longs are still in charge, though confirmed weakness cues or morning panic dumps are short entries. Positive price action is another long entry. See my previous comments on this, which are still appropriate. Over 3 now, how far can it go?

MONT

New Supernovae scan return. Low volume riser initially, and it closed off of the highs. Volume has picked up a lot. This probably sneaked up on a lot of people. Eventually this can be shorted since it is up so absurdly. I suspect like many such plays it can go further than anyone expects, though. Conditional entry. On a higher open, it might yield a rapid green to red on Thursday and spike down for a short scalp. This might even be a gap and crap. A fade on confirmed weakness cues or heavy dumping on volume from or near the bell. Ideal is a flat or barely green or red open, followed by a big move down on volume to short into. Avoid big gaps, especially downward ones. Do not short into initial strength or greening. Box and drop to wait for the distribution print, if desired and avoid top fish timing fades. Keep flat on positive price action, avoid scalping long, since it has sported more measured moves on up. Down over 5% after hours, but this is still in play.

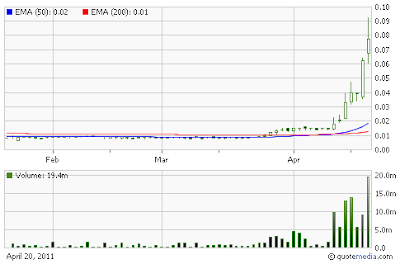

TECO

Cheapie I have been following a while now and just added to my main list as a possible short. It might not be done yet, possibly .10 could hit before a sell off. Up about 6.5% A/H. A firm with more liabilities than assets, I am short on confirmed weakness cues or heavy volume sell dumps anywhere they arise. I'm flat on more greening or positive price action, since this is up so much already and mostly on PR.

TIVO

In play 2 ways. First, given the legal news and excitement it might spike up hard for a few candles from or near the gun, which is a long scalp entry and exit on dying momentum. Second, given that it is up another 2% after hours over 11, we might see an early or from bell dump, to short scalp with a possible EOD exit or day trade short on a fall back under the above number. I am hoping for a more measured move to fade into.

JAG

6 test looming. Possible long on the attempt, and certainly on a take and hold with volume of that level. Another early feedback set up which is usually desirable. This helps in formulating stops. Potential short on a fail at 6 or a dump at or near the bell. No move on the A/H quote. Nice moves, gaps and volume recently.

ACAD

New 52's. Short term, these yearly high stocks usually go higher. Consistently strong price action, like trading above the opening price level after the first 5 minutes, is a long. Or, if it gaps down a bit to debut or opens flat and falls briefly, a red to green and hold with strong volume. Also long on spiking up at or near the gun as a scalp. This might be an EOD exit, depending on how it holds up. Also long on a break above to new yearly highs and holds. Avoid shorts. Keep flat on enduring weakness. No after hours quote shift. A pull back entry on a 2 test that solidly holds and retools back upwards is possible for long swings. This might be ideal in fact.

IMRS

Analysis is similar as for the above stock, with some explanations and differences. Almost at new yearly highs, this one is also up A/H even closer. This is at 8.42 and I am long on a take and hold of that with volume. A clear fail there is a fade entry. Another early feedback type set up which helps with stops and assessment.

Off record, I am also watching FLWS another new 52's situation. Earnings at open on Thursday, so be aware of possible selling into the report. Up almost 5% A/H with a possible 4 test in view. If that holds it could be longed. High potential for a fail at 4, which could be faded. An earnings play at yearly highs shorted? It's risky but the psychology is there at 4 if they decide to sell off it. Not on my main list given the variables.

Review my blog at Investimonials:

Follow me now on Twitter:

Watch my instructional trading videos on YouTube:

Subscribe to Big T by e-mail:

Subscribe to Big T in a news reader:

The blog has a terms of service. Be sure to read it at:

http://traderbigt.blogspot.com/2010/02/please-read-my-terms-of-service-i.html

No comments:

Post a Comment